SMEs are weighing whether the Department of Small Business Development’s reopening of the Asset Assist Programme can help close the persistent funding gap that continues to limit growth across key sectors. The programme offers grants of up to R250,000 to qualifying businesses to acquire productive assets such as machinery, tools, vehicles and equipment.

The reopening of the funding window comes at a time when many SMEs are under pressure to expand capacity but remain locked out of traditional bank finance. Business owners say asset financing remains one of the hardest forms of funding to secure, particularly for enterprises without property or significant collateral.

Soweto-based metal fabrication business owner Sipho Ndlovu said access to equipment funding has been a long-standing challenge.

“We have work, but our machines limit how much we can take on. Banks want security and long track records. A grant like Asset Assist could help us upgrade without putting the business at risk,” he said.

Ndlovu said investing in better equipment would allow him to reduce outsourcing costs and speed up production, but cash flow constraints have delayed those plans for more than a year.

According to the Department of Small Business Development, the Asset Assist Programme is intended to support business growth by funding productive assets rather than operating expenses. The department said the programme prioritises businesses that can demonstrate how the asset will improve productivity, sustainability and job retention.

For many small enterprises, however, access to the programme is shaped by compliance requirements. Durban-based cleaning services entrepreneur Zanele Mkhize said meeting documentation standards remains a hurdle for smaller firms.

“The funding is helpful, but many businesses struggle with tax clearance and formal financial records. Without guidance, people drop out before they even apply,” she said.

Mkhize said equipment such as industrial cleaning machines and vehicles could significantly reduce operating costs, but smaller businesses often lack the administrative capacity to navigate application processes independently.

Previous beneficiaries of Asset Assist have reported that the programme helped unlock growth, although approval timelines and payment processes varied. Business advisors working with SMEs say clearer communication around application timelines and support mechanisms would improve uptake, particularly among township and rural enterprises.

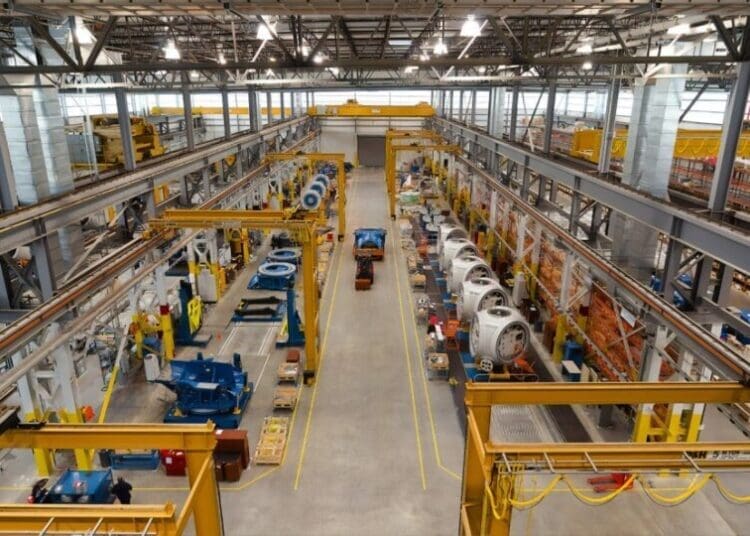

According to the department, the programme is open to registered and compliant SMEs across multiple sectors, including manufacturing, construction, agriculture and services. Assets funded through the programme must be directly linked to business operations and revenue generation.

Asset investment remains central to improving competitiveness and productivity as SMEs plan for the year ahead.

lazola@vutivibusiness.co.za