Small businesses are still feeling the pinch despite recent economic growth, with many consumers sticking to essentials and delaying larger purchases.

Gugu Bhengu, founder of Gugu Mobile Boutique, a Durban-based entrepreneur specialising in handmade African fashion and accessories, told Vutivi Business News that her boutique has yet to feel the impact of the economic recovery.

“Customers are still very cautious. Even though there’s a slight improvement here and there, most people are buying only essential items or smaller, affordable pieces. Big purchases have slowed down, and clients often delay orders until they are more financially stable,” said Bhengu.

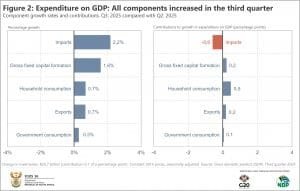

Statistics South Africa (Stats SA) released the latest GDP figures showing that the economy grew by 0.5% in the third quarter of 2025, marking the third consecutive quarter of growth following the 0.9% expansion in the second quarter.

The government welcomed the results, saying the continued improvement reflects the resilience of the economy and the impact of ongoing structural reforms to support inclusive and sustained growth. The trade, catering, and accommodation sector grew by 1.0%, mining expanded by 2.3%, and growth was also recorded in finance, real estate and business services, manufacturing, and agriculture.

Yet, Bhengu explained that for small businesses, the official growth figures haven’t translated into better sales.

“To be honest, I don’t feel that growth is directly in the business yet. On the ground it is still tough sales are inconsistent, and consumer spending is weaker than what the official numbers suggest. The growth hasn’t translated into better cash flow for small businesses like mine,” she said.

She highlighted the pressures heading into 2026,“The biggest pressures are supplier costs, especially for materials and stock, electricity, due to high tariffs and the need to use alternative power during outages, transport costs, which increase the price of sourcing and delivering products, and rent, which keeps rising even when sales are slow.”

Despite these challenges, Bhengu remains cautiously optimistic.

“Small businesses are resilient, and there is still a demand for quality local products. But survival will depend on controlling costs, attracting consistent customers, and adapting quickly to the economic environment. Growth is possible, but it will require support and stable operating conditions,” she said.

She also outlined what she believes could help small businesses thrive.

“Government should lower electricity costs, more support for small manufacturers and crafters, faster payment of invoices, and easier access to grants. Banks, flexible funding options and lower-interest small-business loans. Customers. continued support for local brands, early ordering, and buying directly from small businesses instead of relying on imports.”

As South Africa moves into 2026, small business owners like Gugu Bhengu remain cautious. While Stats SA’s GDP numbers point to a gradual recovery.

basetsana@vutivibusiness.co.za