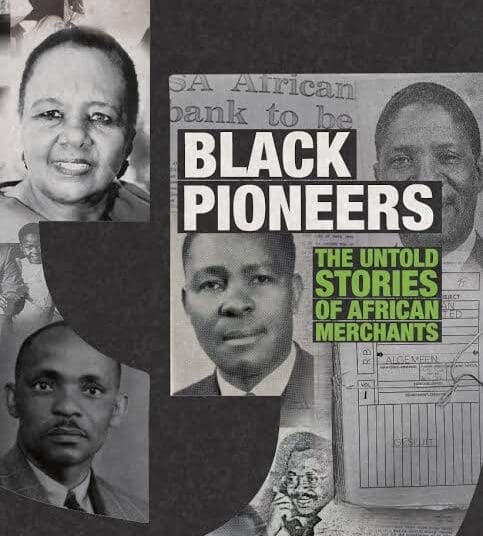

As Nafcoc celebrates its 60th birthday, Phakamisa Ndzamela offers insights into the formation of the body in his book – Black Pioneers.

Ntate Sam Motsuenyane- From blue collar worker and tea maker to director of multiple boardrooms years after the idea of African Bank was conceived. Ntate Motsuenyane has sailed to the celestials shores to join a heavenly boardroom filled with pioneering entrepreneurs.

He joined the company of late business stalwarts such as Amos Gadi, Archie Nkonyeni, Augustine Motsepe, Bigvai Masekela, Boy-Somhle Zuma, Constance Ntshona, Hezekiah Pitje , John Mavimbela, Patrick Gumede, Paul Mosaka, Richard Maponya, Solomon Lesolang and many unsung merchants in the struggle for black traders’ rights.

I mention these businesspeople to illustrate the sociological context that influenced Ntate Motsuenyane’s business trajectory and his business intelligence quotient.

His business career transcended both the apartheid era and post-democratic period. Many businesspeople of old struggled to transition from the closed homeland and township trading environment to a more competitively difficult economy characterised by eSixtymerging domestic and international players.

When the corporate tectonic plates shifted post-1994, Ntate Motsuenyane was there as a director of Corporate Africa alongside the late Dr Ntatho Motlana. Corporate Africa controlled New Africa Investments Limited (Nail), the ground-breaking black owned investment holding company that did a pioneering empowerment deal with Sanlam during the sale of Metropolitan.

Deep into South Africa’s democratic era Ntate Motsuenyane’s citrus farming projects remained actively fertile, debunking the myth that children of sharecropping farm labourers could not farm.

Under an almost barren trading environment for black people, during apartheid, Ntate Motsuenyane ploughed hard for black business advancement. It was during his leadership that the National African Federated Chamber of Commerce (NAFCOC) created an insurance venture. On February 4, 1979, the Sunday Times reported that a large American company Sentry Life was linking up with Permanent Life Assurance and NAFCOC. In the arrangement Ntate Motsuenyane joined the Permanent Life Assurance board. The background to the transaction was that NAFCOC had owned shares in a joint venture with Permanent Life.

Ntate Motsuenyane was also the founding chairman of The Sizwe Medical Fund launched in 1978 by a group of medical doctors comprised of Dr Motlana, Dr Abner Tlakula, Dr Ndumiso Mzamane and Dr Phaki Mokhesi.

It was during his NAFCOC chairmanship when the mega supermarket and retail commercial Black Chain was formed under the chairmanship of Solomon Lesolang.

Way before immersing himself with great business giants Ntate Motsuenyane had to complete his final high school grade part time as he had to find employment. He pedalled his bicycle around Johannesburg in search of blue collar jobs and during his days as a worker, he laboured while studying and managed to complete his matric, despite many tribulations including being imprisoned.

Ntate Motsuenyane sold his labour as an “office boy” and messenger. In his other jobs his responsibilities included making tea for the directors and factory staff, collecting the mail from the Post Office and preparing soap parcels for the employees.

After matric he pursued a Diploma in Social Work from the erstwhile Jan H. Hofmeyer School of Social Work.

Arguably the biggest significance of Ntate Motsuenyane’s career was his presence at the NAFCOC conference in 1964.

During that period Ntate Motsuenyane had completed a Bachelor of Science in Agriculture degree at the University of North Carolina in America. In his travels to America he also visited North Carolina Mutual, then the largest black insurance company in the United State of America. There he also saw the Farmers and Mechanics Bank. He met with National Bankers Association, an association of black financial institutions, gleaning inspiration from Black American financial services professionals.

Ntate Motsuenyane was not alone in his experience. During the 1964 NAFCOC conference, Collins Ramusi, a lawyer by training and graduate of North Western University had also returned from America after furthering his studies. At the NAFCOC 1964 conference Ntate Ramusi alongside Ntate Motsuenyane, highlighted the importance and impact of black-controlled financial institutions. Ntate Ramusi shared observations on how black Americans had successfully started their financial services firms, such as banks, building societies, and insurance companies.

On the origins of African Bank, Allan Wentzel, the first African Bank General Manager, devout Christian Chartered Accountant and merchant banker shared that he met Ntate Motsuenyane through the South African Council of Churches( SACC). Ntate Motsuenyane was a member of the Methodist Church. The SACC had worked with NAFCOC ahead of the registration of the bank.

Wentzel narrated that the SACC raised funds from German churches for administration work and publicity purposes leading up to the registration of African Bank. Wentzel showered praise on Ntate Motsuenyane, crediting him for bringing in a group of very intelligent black directors.

The first generation of African Bank’s Board of Directors were the merchants

Amos Gadi, Patrick Gumede, Solomon Lesolang, Registone Mbongwe, Ntate Motsuenyane,, John Khaas and Enos Sikakane.

The board also included white bankers as directors as per the requirements of the South African Reserve Bank and these individuals included Henry Sargent Liebenberg, Desmond Havinga and Colin Harry Waterson, all from Johannesburg with Wentzel as the first General Manager of the bank.

Ntate Motsuenyane, with Wentzel, would play a key role in the negotiations leading up to the onboarding of the five major banks and directors.

“We were able to take people with very limited financial skills in banking to become part of the Board of Directors, to form a strong Board of Directors and that was under the gentle guidance of Dr Motsuenyane,” recalled Wentzel. He would add that at the time there were not many black directors in South Africa who had served at a senior role at a bank with the experience to understand credit assessments.

One of the popular black bankers at the time were Llewellyn Mehlomakhulu and Tom Molete employed by Barclays. In the new book “The Journey of The Soweto Entrepreneur since 1905”, Andrew Lukhele adds that other influential bankers included Henry Lugojolo at Standard Bank.

Undoubtedly the establishment of African Bank gave an opportunity to black directors to steep themselves in understanding provisioning for doubtful debts and capital adequacy ratios.

Almost fifty years after its birth African Bank, a baby of Ntate Motsuenyane and his comrades, remains a strategic maternity room for the incubation of skilled black bankers.

Phakamisa Ndzamela is the author of Native Merchants, The Building of a Black Business Class and a few forthcoming business history books including Black Pioneers, commissioned by African Bank.