Small importers across South Africa say the rand’s unpredictable swings against the dollar have become one of their biggest operational risks, and many are now watching Standard Bank’s new renminbi payment system with interest.

The system allows businesses to pay Chinese suppliers directly in RMB rather than routing transactions through the dollar, a process that often raises costs before payments clear.

Johannesburg clothing trader Sizwe Mahlangu said the volatility has made it difficult to plan stock purchases.

“You place an order, and by the time the bank releases the money, the rate has moved again,” he said. “Sometimes the final amount is higher than the markup. It puts a lot of pressure on us.”

Durban machinery importer Sibongiseni Mthethwa said fluctuations also strain supplier relationships.

“My suppliers in Guangzhou keep asking why payments arrive short or late. It is the exchange rate changing while the payment is still being processed. If RMB payments remove that delay, it would help us a lot,” he told Vutivi Business News.

Pretoria electronics reseller Kabelo Molefe said the instability forces him to adjust prices more often than customers understand.

“A small dip in the rand makes stock more expensive on the same day,” he said. “Customers think we are changing prices for no reason. If RMB keeps costs steady, it will help us plan better.”

Economist Dr Ayanda Selepe said RMB settlement has grown in other African markets for the same reasons.

“Direct RMB payments reduce exposure to dollar movements and usually clear faster because fewer intermediaries are involved,” she said. “For SMEs, the real benefit is predictability. The question is whether banks will offer the service at a price point small firms can afford.”

Standard Bank has stated that its RMB payment rail is designed to shorten settlement times and simplify trade with China. The bank said the system is available to businesses of all sizes, although it has not provided SME-specific pricing or timelines for broader rollout.

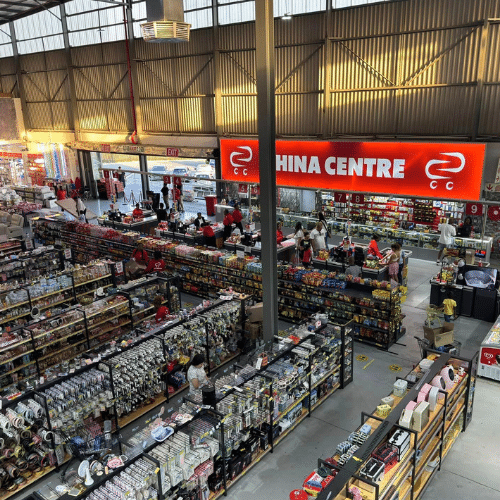

For small retailers who rely on China for clothing, accessories, electronics, cosmetics and small machinery, stability has become crucial. Many operate on thin margins and cannot absorb sudden cost increases caused by intraday rand-dollar swings.

Molefe said even small improvements will matter.

“Sometimes a few cents on the dollar decide whether you make a profit or a loss. If RMB makes things more stable, that alone is a win for us,” Molefe said.

With township traders and urban importers heavily dependent on Chinese stock, SMEs are now watching closely to see whether the RMB system will offer real relief or whether additional fees will limit its usefulness. For those already struggling with unpredictable exchange rate surges this year, stabilising procurement costs is becoming essential.

lazola@vutivibusiness.co.za